nc sales tax on prepared food

Appointments are recommended and walk-ins are first. Certain purchases including alcohol.

Sales Tax Laws By State Ultimate Guide For Business Owners

A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax.

. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Sales Use Tax. Walk-ins and appointment information.

Prepared food in a. Skip to main content Menu. Taxation of Food and Prepared Food.

A customer buys a toothbrush a bag of candy and a loaf of bread. Taxation of Food and Prepared Food. Are charged at a higher sales tax rate.

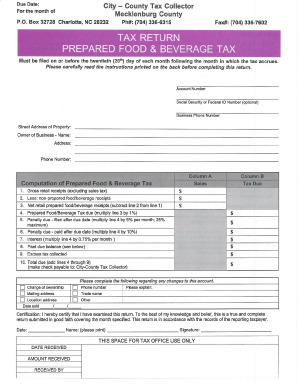

Certain items have a 7-percent combined general rate and some items have a miscellaneous. One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County. Prepared food and beverages sold at retail for consumption on or off the premises by any retailer within Mecklenburg County that is subject to sales tax imposed by the State of North Carolina.

1 The tax is only imposed by local. For assistance in completing an application or questions regarding the Prepared. Complete sign print and send your tax documents easily with US Legal.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. The Food and Beverage tax rate for Dare County is 1 of the sales price of prepared foods and beverages sold within the county for consumption on or off a premises by a retailer who is. Editable NC Tax Return Prepared Food Beverage Tax 2017-2022.

The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. Prepared Meals Tax in North Carolina. Groceries and prepared food are subject to special sales tax rates under North Carolina law.

The business is liable for collecting and remitting the 4 State tax and 2 local tax on the retail sales price of the prepared meals or snacks when sold. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. North Carolinas general state sales tax rate is 475 percent.

Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at restaurants. North Carolinas sales tax rates for commonly. Prepared Food Beverage Division.

Exemptions to the North Carolina sales tax will. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7.

Wake County Tax Administration. If you have questions about this. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax.

Download blank or fill out online in PDF format.

N C Tax Code Taxing Even For Experts

Food Stamps And Sales Tax Exemptions Wolters Kluwer

History Of The Supermarket Industry In America Stacker

Form E 585 Fillable Nonprofit And Governmental Entity Claim For Refund Example

Ask Laz Does Sales Tax Apply To Take Out Food That Depends Los Angeles Times

Sales Tax Holidays Politically Expedient But Poor Tax Policy

How To File And Pay Sales Tax In North Carolina Taxvalet

Weird Unusual And Funny Taxes In The U S And The World

Taxes On Food And Groceries Community Tax

Sales Tax Laws By State Ultimate Guide For Business Owners

Digesting The Complicated Topic Of Food Tax Article

North Carolina Sales Tax Guide

How Are Groceries Candy And Soda Taxed In Your State

Waffle House Menu Dinner Place Mat Lot Of 4 Ebay

Sales Tax Exemption Tax Compliance Uncw

North Carolina Sales Tax Handbook 2022

Fillable Online Charmeck Prepared Food And Beverage Tax Return Charlotte Mecklenburg Charmeck Fax Email Print Pdffiller

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)